The EU fishing fleet is exempted from paying fuel taxes; these fuel-tax exemptions are indirect capacity-enhancing subsidies. High fuel prices and taxation can incentivise faster decarbonisation of industries1, hence such indirect subsidies stand in the way of a more environmentally friendly EU fishing fleet.

With this exemption, the EU currently provides fuel tax subsidies to its fishing fleet to the tune of between €700 million and €1.3 billion each year.

But under the European Green Deal and Fitfor55 package, every industry in the EU should both reduce emissions and cut fossil fuel subsidies2. In fact, the European Commission is now proposing to revise the Energy Taxation Directive (ETD)3, and to include in it a tax rate of €0.036 per litre. This rate is much lower than e.g., the rates used for road transport.

Yet a number of EU Member States are currently proposing to continue exempting the fishing industry from paying fossil fuel taxes.

Instead of these exemptions, the EU could use the revenue generated from a fossil fuel tax to support the fishing fleet in ways that are not only different but more beneficial to its long term future. Well- designed subsidies can enhance environmental and human well-being4. Instead of fueling carbon pollution and potentially unsustainable fishing, the EU could use the tax revenue from fossil fuel taxes to support decarbonisation, create sustainable jobs and increase the transparency of fish catches and trade.

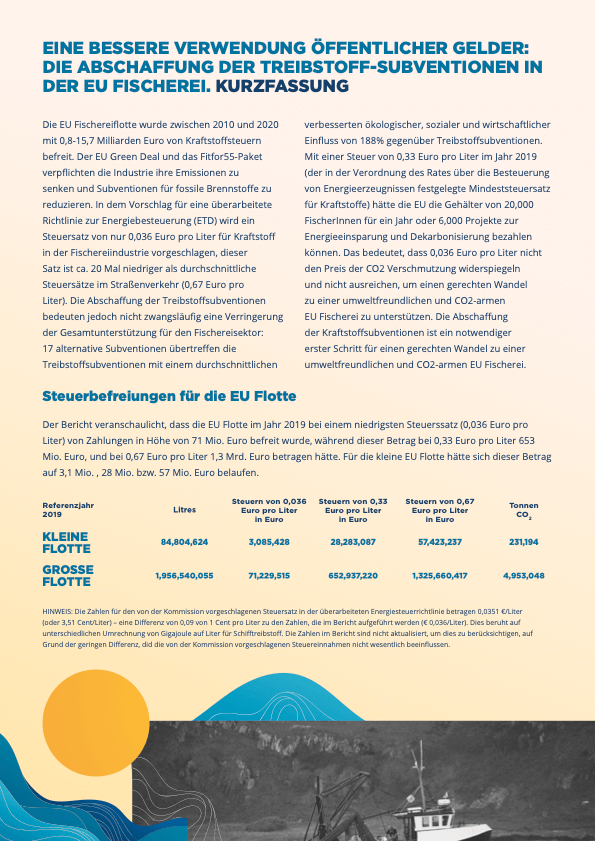

This report calculated the exempted taxes for the EU large and small-scale fleets over the period 2010- 2020 for three different scenarios of taxation: the European Commission proposed tax rate of €0.036 per litre, and two higher taxation rates used for land- based activities. Tax scenarios then illustrate what could be done with the vast tax revenue generated to support the fishing industry in achieving a just transition to low-impact and low-carbon fishing in the EU.

Other languages: